Can You Afford a Home? (More Likely Than You Think!)

Have you been looking at the new home market in Calgary recently and thought to yourself “I’m never going to be able to afford this”. If so, you’re not alone. It’s no secret that home prices in Calgary have steadily risen in the past few years. While we would never recommend putting yourself in a difficult financial situation to buy a home, there are a few tips, tricks and ideas we can offer to help you better understand what’s going into the pricing of a home, and what resources you can use to make your potential home more attainable.

What affects the pricing of a home?

As a new homebuilder, a question we often get asked is what factors go into the pricing of a new home? The answer is A LOT. It’s almost impossible to give a broad answer to this question, as pricing can depend on so many factors from something as big as which home model you choose, to as small as which closet shelves you want installed.

As a rule of thumb, a home price is made up of three major groups. Costs related to the lot, costs related to the home, and taxes and fees.

Lot costs are based on the unique location of the home. Corner lots, walkout lots or larger lots often cost more than others. The location of the community can also affect the lot price.

Home prices are based on the cost of labor, materials, build time and finishes chosen. Higher end finishes will raise the price of a home, while less customization will lower it.

Taxes and fees are self-explanatory. GST, municipal tax, sales fees etc. are all to be expected when you buy a new home.

Finally, included in the price of all Shane Homes is our ability to customize. Unlike most builders, if you want to make changes to your floorplan, we offer this as a complimentary service when you buy with us. If you just want to move some walls, change a layout or tweak a floorplan, we offer that service. Costs attributed to customization come in when we’re adding square footage and materials. The inverse of this can also be true if you decide to reduce the size of your floorplan.

How much do I need for a down payment?

Contrary to popular belief, in order to buy a home in Alberta the minimum amount you need to put down on the home is just 5%. In this case you’ll be required to purchase mortgage insurance, but at least it’ll get you into a home!

There are a few exceptions to this rule, however. The 5% rule only applies to houses under $500,000. On houses from $500,000 to $1,000,000 you will be required to pay 5% down on the first $500k, then 10% on whatever the remaining value of the home is. If the house is over $1M, then you’ll have to put the full 20% down.

How does this look in the real world? Take a house worth $635K. You’ll have to put 5% down on the first $500K, which comes out to $25,000, plus 10% on the remaining $135K, which comes out to $13,500. This brings the total required downpayment to $38,500, which is far less than the $127,000 required for a 20% down payment.

What can I do to lower the price of a home?

While there is no perfect solution to lower the cost of a home, a few things you can consider are:

- Choose a smaller lot

- Choose a smaller, or different home model (or customize your home to be smaller!)

- Build in a more affordable community

- Avoid excessive upgrades

- Use the builder provided services such as lawyers, real estate agents or mortgage experts

- Negotiate

What are some ways to lower my mortgage?

With mortgage rates the way they currently are, we understand the desire to look for any form of relief where possible. Some solutions are as follows.

Put More $ Down

By putting more money down on the home, you owe less money to the bank, and in turn own more of your home sooner. One idea to consider would be to buy a home that is a bit more affordable than the max amount you can afford, and instead use those cost savings on the down payment. If sacrificing features is your concern, consider that we offer customization on most of our home models, so there’s a good chance you can still get that standout feature added to your smaller home model.

Use The First Time Homebuyers Incentive

The Government of Canada currently offers a first time homebuyers incentive to those looking to purchase their first home. The incentive offers up to 10% of the purchase price of a new home to be put towards the down payment. This can help substantially lower your monthly mortgage costs. For full details on the incentive, see the above link.

Take Advantage of the FHSA

The recently introduced FHSA is a tax-free savings account specifically designed for first time homebuyers. This account allows you to contribute up to $8K a year, tax free to a maximum of $40K in a lifetime. If you’re not quite ready to buy, this can be a great place to invest your potential down payment in the meantime. It’s best to talk to your financial advisor if this is something you’re interested in .

Develop A Legal Suite

We actually wrote an entire blog post on how a legal suite can lower the cost of your monthly mortgage. The full post is here. To summarize; thanks to the rental income you can receive from the legal suite, you can raise your net income to help qualify for a larger mortgage, plus offset some of the costs of your mortgage using the rental income you receive. It can also raise the value of your new home, and further increase its resale value!

Use Our Partners When You Purchase

To help make your purchasing process as painless and efficient as possible, we have partnered with various other companies to offer you benefits when you purchase through Shane.

Both home mortgage brokers can help you find the perfect mortgage for your situation. They compare different rates, can shop lenders and may be able to get you a rate better than what your bank is offering.

Use Our Appointed Lawyer (and we’ll cover your legal fees!)

If you use our appointed lawyer for closing on your home, we’ll cover your legal fees, further reducing the costs of purchasing your new home with us.

Our list for free program will help offset the cost of a realtor commission on your home sale (with some exceptions). Plus, we can even evaluate your current home for FREE, ensuring you understand the suggested asking price for it.

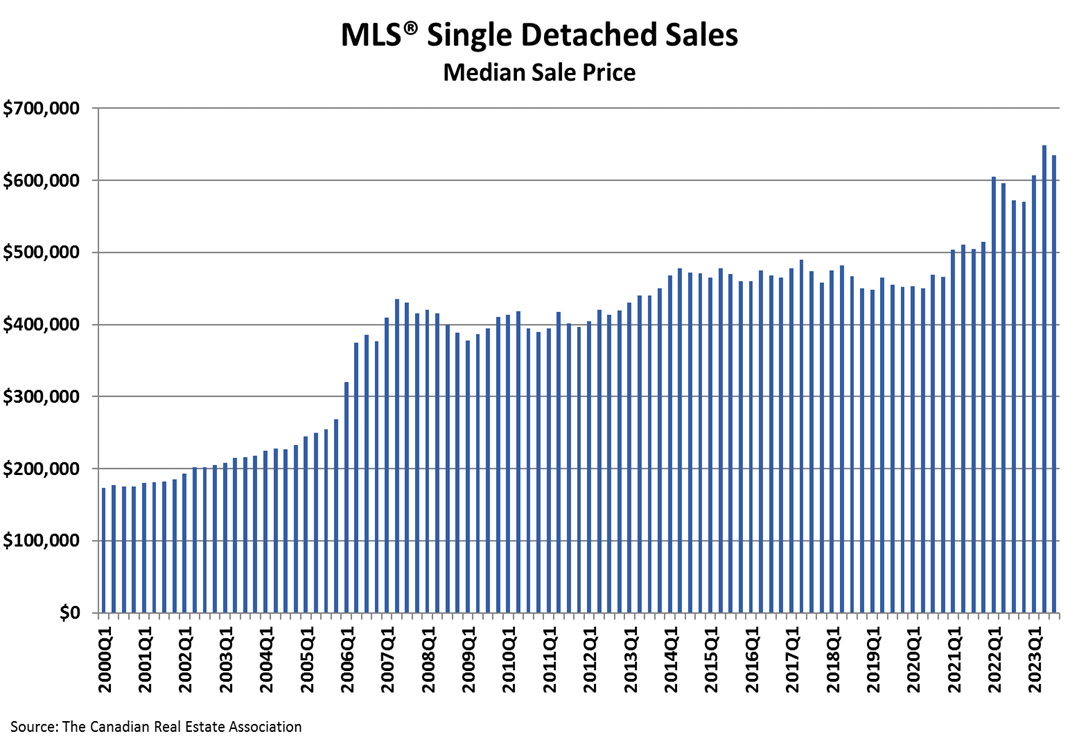

Will House Prices Drop?

The last question we often get asked is will home prices drop? The short answer? No. The long answer is a little more complex.

The housing market is constantly in flux. Prices change month over month, year over year and even daily. The only consistency has been that in the long term, house prices have always risen. Currently the Calgary market is outperforming the rest of Canada , as home prices here continue to rise. Whether or not that holds in the medium term is impossible to predict.

What does this mean for you? Should you wait for a dip to buy, or just take the plunge? The choice is up to you. Our advice? There is never a “perfect time” to purchase, as long as you can financially afford it. Don’t overburden yourself in order to buy a home, but if you’re on the fence waiting to see what prices do, it’s most likely in your best interest to get into the market.

There you have it! A mix of tips, ideas and info that will hopefully come in handy while you consider your home purchase. Thanks for reading!