The Bank of Canada has just announced a 0.25% cut to its key interest rate. As a result, most lenders have reduced their prime rate to around 4.7% from 4.95%. For Canadians considering building or moving into a new home, this is welcome news!

What This Means for You

With the prime rate lower, borrowing has become more affordable. Here’s how this can benefit homebuyers:

- Lower monthly payments on variable-rate mortgages

- Greater purchasing power when qualifying for financing

- More budget flexibility to design and customize your new home

How it Helps Future Shane Homeowners

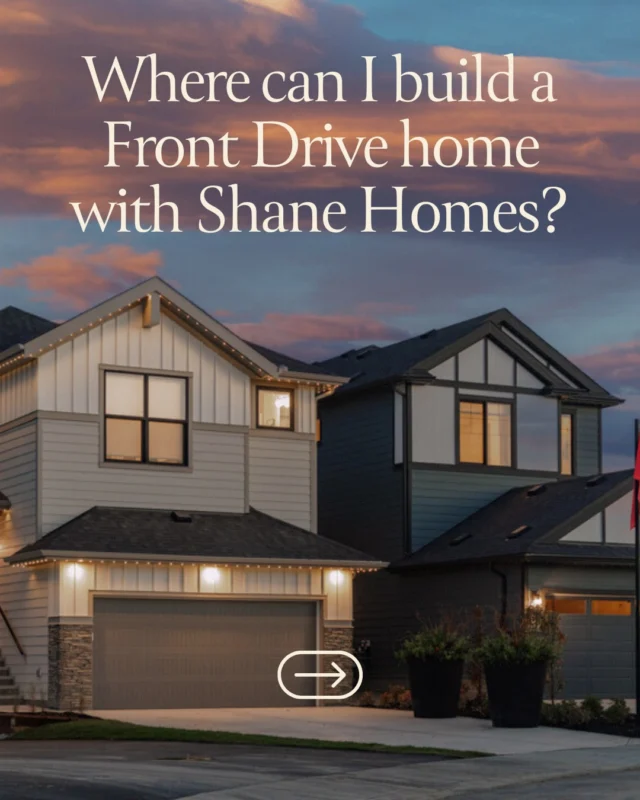

At Shane Homes, we understand how affordability plays a big role in planning for the future. With lower rates, you can dedicate more of your budget to creating a home that truly reflects your lifestyle. This might mean selecting a floorplan that gives your family room to grow, adding extra bedrooms or living space, or choosing upgraded finishes that make everyday life more enjoyable. Lower borrowing costs make it easier to focus on the details that turn your house into a home.

Take Advantage of Today’s Market

This rate cut makes it a great time to start planning your next move with confidence. Our sales team is here to walk you through your options and show you how these lower rates can help bring your new home within reach.

Work With Our Trusted Mortgage Partners

To help guide you through today’s changing mortgage landscape, we work closely with our trusted mortgage partners, inlcuding Mortgage Tree. Their team of experts can help you answer questions, explore financing options, and ensure you find the right solution for your needs.

Mortgage Tree has access to over 30+ Lenders including Banks, Credit Unions and Alternative Lenders. Each Lender is unique on how they qualify clients, pre-payment privileges/options and calculating penalties. Having our experience on your side matters to ensure you receive the right mortgage for your needs today and in the future.

Please contact us at [email protected]

Kent Chapman – Broker Owner/Mortgage Advisor

403-797-2093

Koalby Bojda – Mortgage Advisor

403-978-3898

*Mortgage rates are subject to change and may vary based on individual circumstances. The information provided is based on market conditions as of today and is intended for general guidance only.

![We're very excited about our new duplex model, the Cavell.

This spacious paired home features a main floor bedroom and bathroom as well as 3 spacious bedrooms on the second floor and a flexible family room.

Explore the floorplans over on our website [link in bio]

*Artist’s rendering only

#calgary #calgaryhomes #calgaryhomebuilder #newhomescalgary](https://www.shanehomes.com/wp-content/uploads/sb-instagram-feed-images/571373283_18542256256032008_5820328219297504367_nfull.webp)